Crypto Currencies

Deregulation and decentralization are key to its appeal

A crypto currency or digital currency is a means of electronic exchange. Contrary to currencies issued by the Central Banks (dollars, euros, etc.), the particularity of crypto currencies is that their "production" depends on quotas of natural or legal persons not subject to regulation or intermediation of financial institutions (led by the FED) and states.

This production process is known as "mining", in which networks of people or groups (called miners), equipped with hundreds of super-powerful processors compete on the internet to obtain the reward (crypto currency), by solving mathematical problem-complexes through running random numbers at very high speeds. Whoever manages to find the answer first receives the crypto currency and distributes it among the winning miners.

Although initially designed as a means of digital payment, crypto currencies have migrated into reserve currency, safekeeping of financial assets, or simply as an investment instrument. The value of a crypto currency depends on its demand and its reference to the currency with the greatest global influence such as the euro, the dollar and the yuan.

Blockchain

Blockchain (chains of payment blocks) is a digital ledger book that in a decentralized and public way accounts for all crypto currency transactions. Each node (server connected to this network) is allowed to download a copy of each transaction. This system operates outside of the classical institutions of the international financial system.

It is basically an accounting system that generates a permanent record as a block, guaranteeing a more secure mechanism that is not regulated by a central authority to verify transactions made in cryptocurrencies.

The growth of cryptocurrencies has begun to generate concern among the masters of the world economy, that select club formed by multilateral financial institutions, large central banks and private banks of great weight.

The Bank of International Settlements (BIS), the financial institution that controls almost all transactions worldwide, and is linked to the omnipotent Rothschild cabal of ≈13 families, alerted their banks of the "danger" that the use of cryptocurrencies represented for their global financial system.

The system of crypto currency transactions favors anonymity and is thus used by criminal operations related to drugs and illegal arms trade, which so far were exclusively served by the same banks, who acted as a 'washing machine' for global drug trafficking and for paramilitary groups such as ISIS and Al Queda, etc. all created by the CIA & NATO.

The value of crypto currencies and the US dollar is now mostly based on "confidence" (a psychological factor, not material) since the Nixon administration broke the dollar/gold convertibility.

Cryptocurrencies are not subject to control or intermediation by US and EU-financial institutions. They can improve the lives of millions, and represents a counter-attack against globalist bankers' hegemony and corporate totalitarianism.

In a context of increasingly accelerated financial globalization, where nation-states are losing their internal control capacity, the regulation of crypto-mining in its entirety is highly complicated for anybody or any state.

Russian Central Bank wants to introduce the cryptocurrency on the level of several countries such as BRICS and EEU, as it makes sense to set one equivalent for all payments, in order to replace the US dollar, to negate US sanctions, and to protect a nation's or nations-block's sovereign debt and its financial connectivity in the world.

Russia and China have taken a leading role in the construction of a payment architecture, investment and commercial exchange in the Asian regions in their own currencies. Novel factors that do not necessarily rival the crypto currency.

The Venezuelan crypto currency (El Petro) is backed by the country's oil, gas, gold and diamond reserves, and a Venezuelan Blockchain Observatory to give this digital currency legal and institutional basis.

The Venezuelan crypto currency will bypass the US financial sanctions, with the possibility of issuing debt and offering a degree of anonymity in its centralized Blockchain system, protecting the creditors to be sanctioned and achieve the necessary access to foreign currency.

It is realistic to assume that not all the 750+ different crypto currencies will survive. Ethereum is used for its Smart Contracts, Ripple and Litecoin as innovative, fast micro-transaction payment networks, and Bitcoin as the store of value and a payment network.

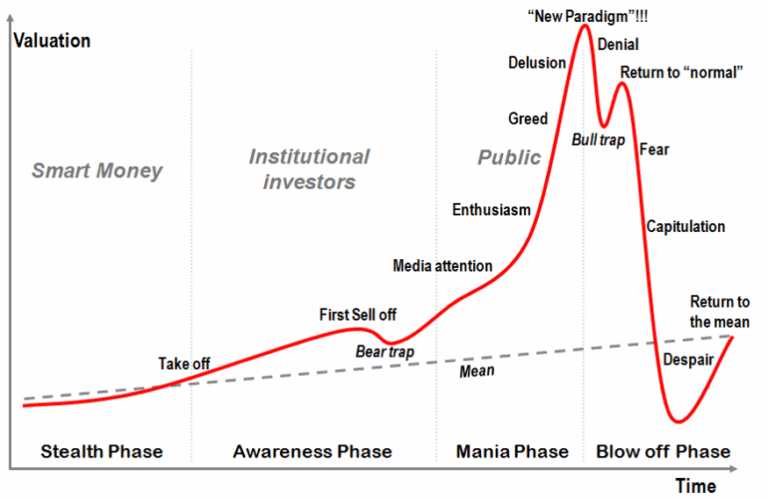

As we see blockchain technology slowly being integrated into the general public’s lives, an even more violent value surges and bubbles and busts may occur, ultimately paving the way for mass adoption of the technology and its uses.

Product Life cycle

Valuable assets (gold, oil, gas) backed crypto currencies, versus current central banks controlled currencies, may become the safest means of exchange in the future.

National cryptocurrencies may enable central banks and governments to increase transparency into their economic activity, trade and import-export relations, when using blockchain to translate their currencies into digits and gain a better control over the financial system, and significantly reducing the volume of the shadow economy.

Digital coins issued by assets-backed enterprises or groups of enterprises may become some of the most secure currencies. Their intrinsic value is then directly related to the publicly traded stock value of those enterprises.